Simplified depreciation calculator

10 million from 1 July 2016. Determine the useful life of the asset.

Depreciation Schedule Template For Straight Line And Declining Balance

Ad Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence.

. Under the simplified depreciation rules you can. Enter the expression you want to simplify into the editor. Find A One-Stop Option That Fits Your Investment Strategy.

If you are using the simplified depreciation rules generally you wont use the UCA rules for low-value pools. Do Your Investments Align with Your Goals. Under simplified depreciation rules you would pool an expensive vehicle into a small business asset pool and claim.

That means the total deprecation for house for year 2019 equals. Here is a very simplified process for the steps we use to calculate Depreciation. Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022.

A quick and clear explanation on how to calculate depreciation using straight line method and reducing balance method. The tool includes updates to. The total amount that can be written off in Year 2020 can not be more than 1040000.

How is the amount of deductible expenses determined under the simplified method. Find a Dedicated Financial Advisor Now. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Before you use this tool. You determine the amount of deductible expenses by multiplying the allowable square footage by. Depreciation deduction for her home office in 2019 would be.

A 15 deduction in the year you bought it. Use the date the property was first available for lease and contract exchange date to determine which. A very simplified way to calculate your annual depreciation deduction is to divide the purchase price of your property by that 275-year number.

Get Started In Your Future. A very simplified way to calculate your annual depreciation deduction is to divide the purchase price of your property by that 275-year number. Need an Easy Accurate Way to Comply with State Depreciation Across Multiple States.

You can choose to use the simplified depreciation rules if you have a small business with an aggregated turnover of less than. Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. 10 rows If you use the simplified method for one year and use the regular method for any subsequent year you must calculate the depreciation deduction for the.

There are several benefits to using the simplified method when calculating your depreciation. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. You will only need to pay the greater of.

Calculating depreciation simplified. Free simplify calculator - simplify algebraic expressions step-by-step. Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount.

Small business entity simplified depreciation rules are available to businesses with an aggregated turnover of less than 10 million dollars after 1 July 2016. Instant undercut The instant asset write-off rule means you can essentially. Divide the sum of step 2.

Enter the expression you want to. There is also a limit to the total amount of the equipment purchased in one year. The simplification calculator allows you to take a simple or complex expression and simplify and.

270000 x 1605 43335.

Depreciation What Is The Depreciation Expense

How To Calculate Depreciation Youtube

Simplified Home Office Deduction Explained Should I Use It

Depreciation Calculator For Home Office Internal Revenue Code Simplified

The Best Guide To Maximising Small Business Depreciation Box Advisory Services

/Term-Definitions_depreciation_FINAL-c4437bbc37bf455588e59e1eb11dd299.png)

Depreciation Definition

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Computer Generation Excel

Depreciation What Is The Depreciation Expense

Calculate Depreciation In Excel With Sln Straight Line Method By Learnin Learning Centers Excel Tutorials Excel

Depreciation What Is The Depreciation Expense

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Depreciation What Is The Depreciation Expense

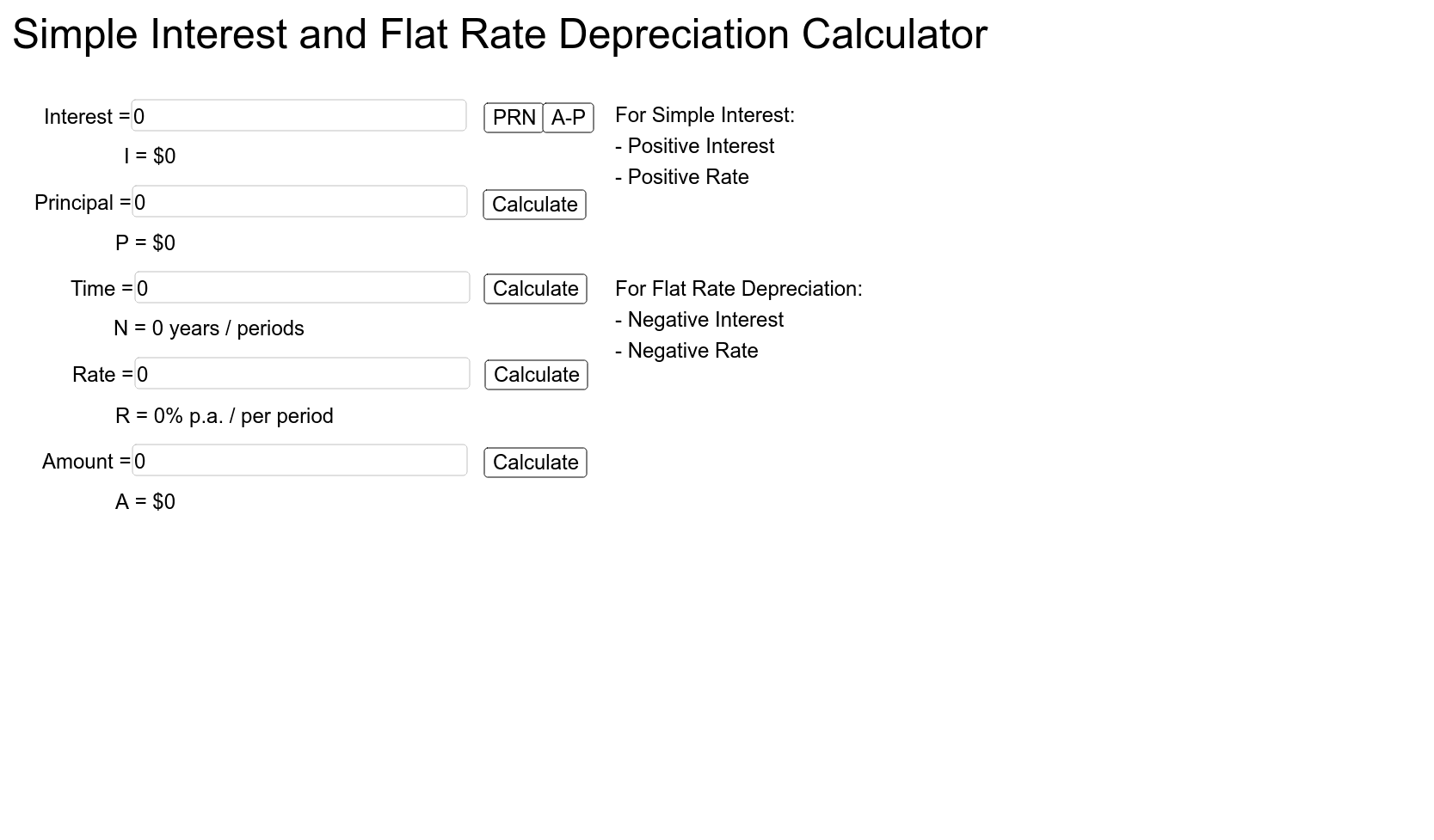

Simple Interest And Flat Rate Depreciation Calculator Geogebra

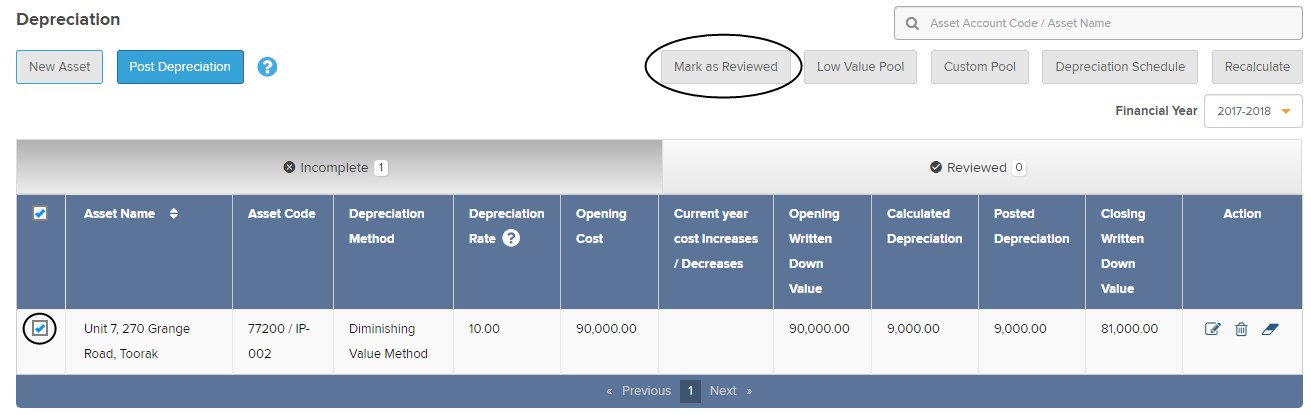

Depreciation Schedule Simple Fund 360 Knowledge Centre

/StraightLineBasis-bfb937d99f9d49ac9a15b8f78ca3b1a0.jpg)

Straight Line Basis Calculation Explained With Example

An Excel Approach To Calculate Depreciation Fm

Calculating Depreciation Youtube